Overview: 2,000 Federal Deposits Confirmed for February 2026

Federal authorities have confirmed a one-time $2,000 deposit to eligible individuals slated for February 2026. This guide explains the essential rules, who qualifies, and how the payments are expected to be distributed.

The purpose here is practical: tell you how to confirm eligibility, what documents or records matter, and when to expect your deposit. Follow the steps below to prepare and reduce surprises.

Key rules for the $2,000 federal deposits

Understanding the basic rules helps avoid missed payments. Rules typically cover who is eligible, how payments are delivered, and deadlines for any required paperwork.

Common administrative points to watch include verification of identity, income limits, and whether the government uses tax records or benefit rolls to determine eligibility. Keep records ready in case a verification request arrives.

Basic administrative rules

- Payments are usually based on the most recent federal records (tax returns or benefit files).

- Direct deposit information on file speeds delivery; paper checks or debit cards are slower.

- Payments can be adjusted or denied after verification if data mismatches are found.

- There may be an appeal or correction window if a payment is missed due to incorrect records.

Eligibility criteria for the February 2026 deposit

Eligibility often follows a few consistent rules across similar federal programs. The most important items are filing status, income limits, and citizenship or residency status.

Below are typical criteria you should check against your own situation.

Who typically qualifies

- U.S. citizens or qualifying resident aliens with a valid Social Security number.

- Individuals who filed a recent federal tax return or are on an active federal benefit program file (for example, Social Security).

- Reported income below the program’s phase-out threshold. Exact thresholds vary by filing status.

- Dependents may be handled differently; some programs exclude adult dependents while others include eligible children.

Documents and records that matter

- Most recent federal tax return (last filed return).

- Social Security number and proof of identity if requested.

- Current direct deposit or mailing address on file with the IRS or benefit agency.

- Records showing qualifying life or family changes (marriage, birth, loss of income).

If you receive federal benefits like Social Security or SSI, agencies often use those records to issue one-time federal payments automatically, without separate enrollment.

Payment schedule and how payments are delivered

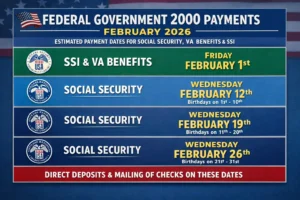

Payment timing typically depends on the delivery method and the agency processing the deposit. Expect a staggered schedule throughout February 2026.

Direct deposit recipients generally receive funds first, followed by mailed checks and prepaid debit cards for those without direct deposit on file.

Typical payment timeline

- Early February: Agencies begin processing and validating eligibility data.

- Mid-February: Direct deposits arrive for most qualifying accounts with updated bank info.

- Late February to March: Paper checks and prepaid cards are mailed to recipients without direct deposit.

- Follow-up weeks: Corrections, appeals, and late adjustments are handled in the weeks after initial payments.

How to confirm your eligibility and track the $2,000 deposit

Confirming eligibility early avoids surprises and speeds corrections if records are wrong. Use official agency accounts and documented proof whenever possible.

Key actions you can take now include checking your tax account and updating direct deposit details where needed.

Step-by-step checklist

- Log into your official federal tax or benefit account (for example, the IRS or relevant benefit portal) to check payment status.

- Verify your mailing address and direct deposit information is current.

- Review your latest tax return for correct filing status and reported dependents.

- Gather proof of identity and income in case you need to respond to a verification request.

What to do if you don’t receive the deposit

If you expect a payment but don’t receive it, start by verifying records. A missing deposit often means a mismatch in name, Social Security number, or bank details.

Contact the agency that issued the payment and follow their correction or appeal process. Keep copies of all communications and documentation.

Quick troubleshooting steps

- Check your online account for payment notices or error messages.

- Confirm that your bank did not accept a deposit on behalf of a joint account without notice.

- If a paper check is missing, check the mail and report a non-delivery promptly to the issuing agency.

Real-world example

Case study: Maria, a single filer, confirmed she qualified based on her 2024 tax return and had direct deposit on file. She checked her tax account in early February and saw a payment scheduled for mid-February.

Maria received the direct deposit on February 16, 2026. Because she kept her bank info up to date and filed early, her payment arrived without issues. When a friend missed a payment, a record mismatch was found and fixed within two weeks after contacting the agency.

Final tips and practical reminders

Keep documentation organized and monitor official channels for updates. Do not share personal information in response to unsolicited calls or emails claiming to confirm your payment.

If you are unsure about your eligibility, use official agency portals and hotlines. Document all steps you take and save confirmation numbers for future reference.