About the 2,000 Federal Direct Deposit in February 2026

The federal government has confirmed a $2,000 direct deposit payment scheduled for February 2026. This article explains who is eligible, the confirmed payment dates, and steps to check your deposit status.

Read each section for clear instructions on eligibility rules, documentation you may need, and actions if the deposit does not arrive.

Who is eligible for the 2,000 Federal Direct Deposit?

Eligibility depends on the specific federal program funding the payment. Generally, qualifying factors include income thresholds, filing status, and recent tax or benefit filings.

Common eligibility criteria include:

- Filing a 2024 or 2025 federal tax return, if required.

- Meeting income limits set by the program.

- Being enrolled in specific benefit programs (for example, certain tax credits or relief programs).

How to verify your eligibility

Check the official program page or IRS notices for confirmation. Many federal payments use IRS records, so a recent tax return is often required.

If a benefits agency or state is involved, visit their site and have your Social Security number and recent tax information ready when checking status.

Confirmed payment dates for February 2026 direct deposit

Officials released a payment calendar indicating several direct deposit waves in February 2026. Exact dates can vary by taxpayer group and processing batch.

What to expect:

- First wave: early February for recipients who already receive federal benefits by direct deposit.

- Second wave: mid-February for taxpayers with completed tax returns and direct deposit on file.

- Final wave: late February for those needing manual verification or address updates.

How payments are scheduled

Payments are processed in batches by tax ID or benefit enrollment. If your account is on file with the federal agency, the deposit posts on the scheduled batch date for your group.

If you updated direct deposit or banking details after the cutoff date, your payment may shift to the later wave.

How to check if your $2,000 direct deposit is coming

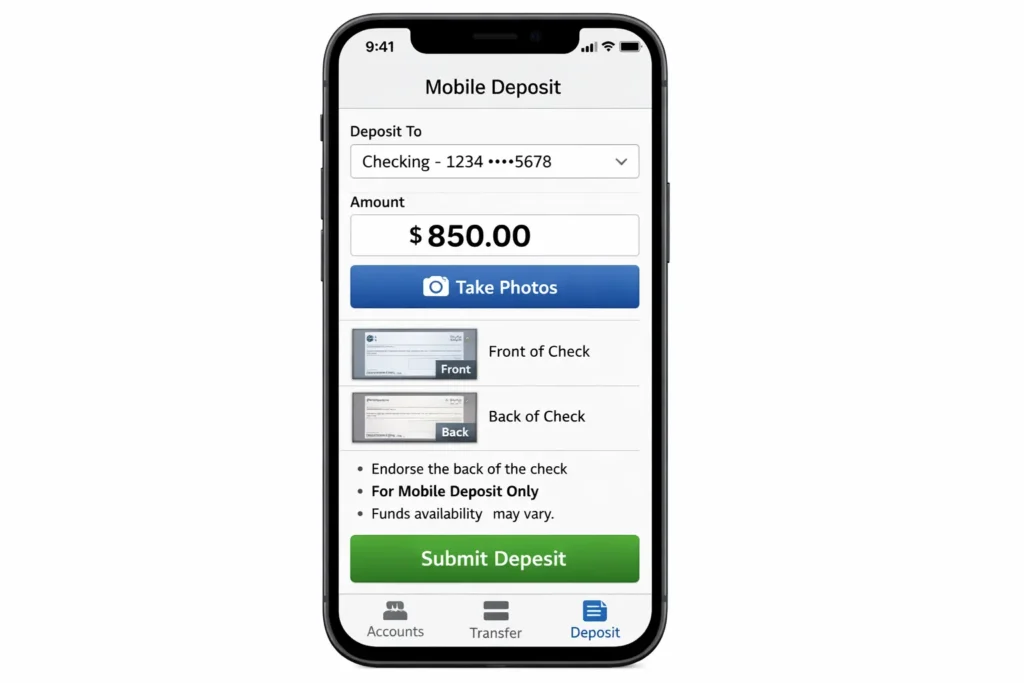

Use the following steps to confirm your payment status. Start with federal systems, then check your bank.

- Visit the official agency website responsible for the payment (IRS, Social Security, or other federal agency).

- Use any payment tracking tools offered, such as “Where’s My Payment” style portals.

- Check the bank account listed for direct deposit for pending transactions on the confirmed dates.

- Contact your bank only if a scheduled deposit posts but your balance does not reflect it after 24 hours.

Information you will need

Have these items ready when checking or calling agencies:

- Social Security number or tax ID

- Filing status and latest tax return year

- Bank routing and account number (if updating deposit info)

Federal direct deposits often post late in the day. If your bank lists a pending deposit on the expected date, the funds may be available within 24 hours. Direct deposit timing can also be affected by weekends and bank holidays.

What to do if you don’t receive the $2,000 direct deposit

If the deposit does not appear by the end of the confirmed payment window, follow a step-by-step approach to resolve the issue.

- Confirm eligibility and that your direct deposit information is correct.

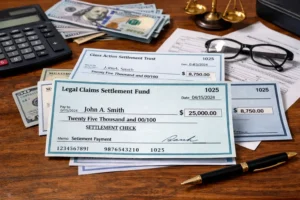

- Check whether the payment was issued as a check or Electronic Funds Transfer (EFT).

- Contact the issuing federal agency to request a trace or issue report.

- If your bank received the payment but it was returned, ask the agency if a mailed check was sent and confirm your mailing address.

When to contact a federal agency

Contact the issuing agency if 14 calendar days have passed since the final confirmed payment date for your group. Keep records of all communications, including names, dates, and case numbers.

Tax and reporting considerations for the February 2026 payment

Whether the $2,000 is taxable depends on the program. Some federal payments are tax-free, while others are taxable income or considered a refundable credit.

Steps to prepare:

- Save any IRS letters or notices related to the payment.

- Check the program guidance on whether the payment is taxable for federal or state tax purposes.

- Include the payment on your next tax return only if required by the program rules.

Real-world example: A quick case study

Maria, a single parent, filed her 2025 taxes in March 2025 and set up direct deposit with the IRS. She qualified for the program due to low income and enrollment in a qualifying benefit.

Her deposit posted during the mid-February 2026 wave. She checked the agency portal, confirmed her bank account was correct, and saw the deposit pending on the scheduled date. The funds were available the following business day.

Maria kept the IRS notice and bank statement for her records in case of future verification needs.

Quick checklist: Prepare for the February 2026 direct deposit

- Confirm program eligibility and documentation.

- Make sure your direct deposit information is up to date.

- Monitor official agency pages for final batch dates and tracking tools.

- Keep records of notices, tax returns, and any communications.

Final tips on the 2,000 Federal Direct Deposit for February 2026

Act early if you need to update bank or mailing information. Processing cutoffs determine which payment wave you fall into.

Use the issuing agency’s official channels first. If you still have issues after following all steps, consider a formal trace request or an inquiry with your bank for returned funds.

Keeping documentation and checking official portals will help you confirm receipt and resolve problems quickly.