This guide walks you through how to determine eligibility and claim the 2000 IRS February 2026 payment. Follow these practical, step-by-step actions to confirm your status and file any necessary claims.

Who can qualify for the 2000 IRS February 2026 payment

Eligibility depends on federal rules issued for this specific payment. Common factors the IRS uses include citizenship or residency, valid Social Security numbers, and tax filing history for the relevant tax year.

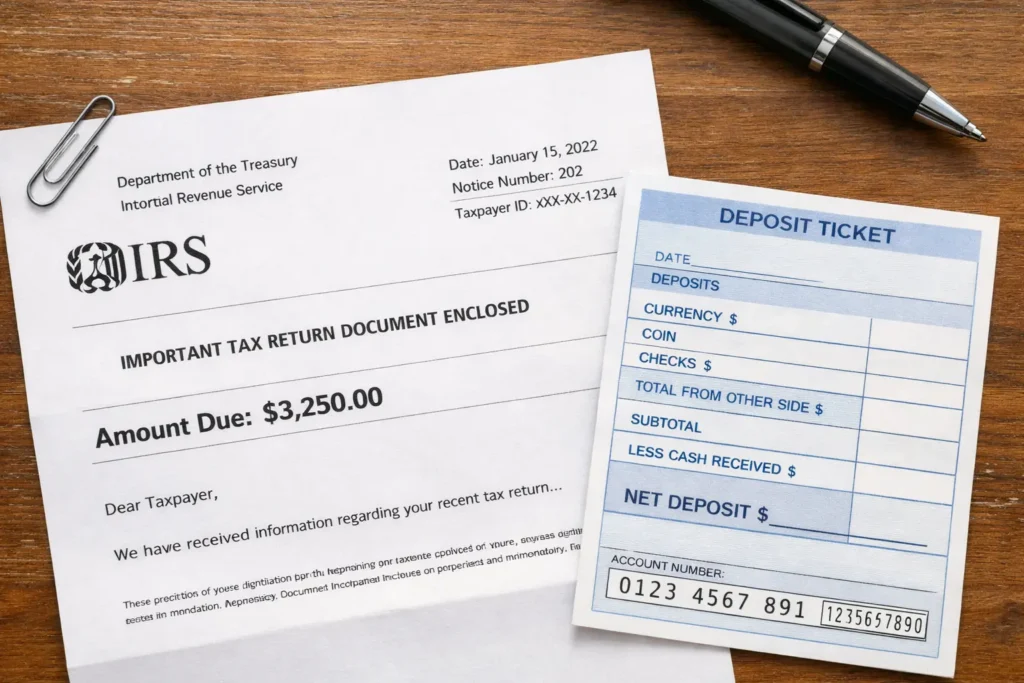

To check your likely eligibility, gather recent tax returns, your Social Security number, and documentation of dependents. If you received a notice from the IRS about the payment, use that as your first reference.

Basic eligibility checklist for the 2000 IRS February 2026 payment

- U.S. citizen or eligible resident with a valid Social Security number.

- Filed a federal tax return for the most recent tax year requested by the IRS (usually 2024 or 2025).

- Adjusted gross income within the phaseout range specified by the IRS for the payment.

- No disqualifying status (certain non-resident filers and some dependents may be excluded).

How to verify if you received the 2000 IRS February 2026 payment

Start by checking your bank account and any IRS notices. The IRS commonly sends letters or posts payment history in online accounts.

Use the official IRS online tools where available, such as your online IRS account or the payments history portal. Keep documentation of any deposits and IRS letters for reference.

Document list to confirm payment

- IRS notice or letter reference number

- Bank statement or deposit confirmation

- Copy of the most recent tax return filed

- Social Security numbers for filers and claimed dependents

Step-by-step claim guide if you did not receive the 2000 IRS February 2026 payment

If you expected a payment but did not receive it, follow these steps in order. This reduces delays and ensures you use the correct IRS process.

Step 1 — Review IRS notices and online account

Open any mailed IRS notices related to the payment. Log in to your IRS online account to view payment history and messages. These sources often explain why a payment was or was not issued.

Step 2 — Confirm your tax return filing status

Make sure you filed the required tax return for the year the IRS references. If you did not file, you may need to file a late return or use a non-filer portal, if the IRS provides one.

Step 3 — Update direct deposit or mailing address

If your bank account or address changed, update it with the IRS. The IRS typically recommends using your online account to set or change payment delivery information.

Step 4 — Claim a missing payment on your tax return

If the IRS directs you to claim a missing payment, this usually happens through a credit or adjustment on your next federal tax return. Follow instructions on the return form and attach any required documentation.

When in doubt, enter the amount the IRS specifies on the line for the relevant credit or rebate claim and keep copies of all correspondence.

Step 5 — Contact the IRS only if needed

If online tools and tax filing do not resolve the issue, contact the IRS. Use official phone numbers or secure messages through your IRS account. Expect wait times; document the date, time, and name of any representative you speak with.

Common errors that delay the 2000 IRS February 2026 payment

Delays often stem from mismatched names or Social Security numbers, unfiled returns, incorrect banking details, or eligibility threshold changes. Correct these quickly to reduce follow-up actions.

Keep records of prior stimulus or rebate payments to compare amounts and avoid confusion.

If you miss a payment, the IRS often provides a route to claim the amount on your next tax return instead of issuing an immediate retroactive check.

Short example: How a filer claimed the 2000 IRS February 2026 payment

Maria, a single parent, expected the payment but did not see it in her bank account. She logged into her IRS online account and found a message saying the IRS had no current banking details for her 2025 return.

Maria filed an amended contact method through the IRS portal and then claimed the missing amount on her 2025 tax return using the specified credit line. Within two weeks of processing, she received the payment by direct deposit.

Practical tips to speed up your claim for the 2000 IRS February 2026 payment

- Keep a copy of every IRS notice you receive about the payment.

- File your tax return on time and include accurate Social Security numbers for everyone on the return.

- Use the IRS online account to update bank or address details promptly.

- If claiming on a tax return, attach supporting documents and double-check the credit amount entered.

- Be patient and track any submitted forms or calls you make to the IRS.

Final steps and where to get help for the 2000 IRS February 2026 payment

Always verify actions with the official IRS website and follow instructions from IRS notices. If you use a tax preparer or volunteer tax assistance site, bring all IRS letters and proof of identity to speed the process.

If your situation is complex — for example, identity theft, incorrect SSN, or residency questions — seek assistance from a tax professional or an IRS advocate office for resolution.

Following these steps will help you determine eligibility and file a proper claim for the 2000 IRS February 2026 payment. Keep records at every stage and verify information through official IRS channels.