Governments sometimes announce large one-time payments to help households during economic disruption. This guide explains what is known about $5000 stimulus checks 2026, who is likely eligible, how payments might be delivered, and steps you can take now to prepare.

Overview of $5000 Stimulus Checks 2026

The $5000 stimulus checks 2026 proposal aims to provide broad financial relief to qualifying individuals and families. Details vary depending on the final legislation, but typical elements include income limits, documentation rules, and a payment schedule set by the issuing agency.

This article focuses on common eligibility frameworks, expected payment dates, and practical actions to ensure you receive any approved payment.

Who Qualifies for $5000 Stimulus Checks 2026?

Eligibility usually depends on income, filing status, dependent claims, and residency. In proposed stimulus programs, authorities balance broad coverage with budget constraints by setting phase-outs.

Common eligibility rules

- Income thresholds: Single filers and joint filers often have different cutoffs.

- Dependent rules: Payments may increase for households with dependents or children.

- Residency and citizenship: Many programs require citizens or qualifying residents; nonresident aliens are typically excluded.

- Filing status: People who filed recent tax returns or used benefit portals are easier to verify and pay.

Example eligibility scenario

One common scenario: full $5000 for single filers under $50,000 AGI, partial payments between $50,000 and $75,000, and no payment above $75,000. Joint filers have higher thresholds, and households with a qualifying child might get an additional amount.

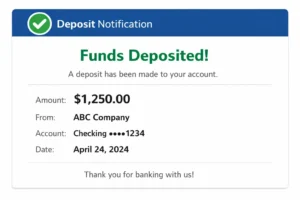

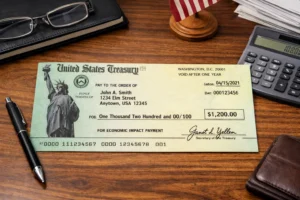

How Payments Will Be Distributed

Payments can be delivered by direct deposit, paper check, or prepaid debit card, depending on your records with the tax agency or benefits office. Agencies prioritize direct deposit when bank details are on file.

Payment timeline and dates

Exact payment dates for $5000 stimulus checks 2026 depend on when legislation passes and how quickly the issuing agency (such as the IRS or a state office) can implement systems.

- Legislation passed in spring: initial payments might begin within 4–8 weeks.

- Staggered payments: early direct deposits first, then mailed checks over several weeks.

- Reconciliation and catch-up payments may continue for months after the initial wave.

What Documents and Records You Need

To speed delivery, keep current your tax filings, bank account information, and contact details with the relevant agency. If you receive benefits, ensure your information is up to date in benefit portals.

Common useful documents include your most recent tax return, Social Security number, proof of residency, and bank routing and account numbers if you want direct deposit.

How to Check Your Payment Status

Most agencies provide an online portal or hotline to check payment status. After a law passes, watch official channels for an online status tool and use your tax or benefit account credentials to check eligibility and payment progress.

- Use official government websites only to avoid scams.

- Look for announcements that list expected payment phases and approximate dates.

Past stimulus programs used IRS tax return data from two different years depending on which filing season information was available. That means if you didn’t file the most recent return, the agency might use an earlier year to determine eligibility and payment amount.

Common Questions About $5000 Stimulus Checks 2026

Will non-filers get the payment?

Some programs include a portal for non-filers to register. If you don’t normally file taxes, watch for official non-filer registration portals to claim a payment.

Is the payment taxable?

Most stimulus checks are tax-free at the federal level, but always confirm once the law is published. The issuing agency will explain tax treatment in program guidance.

Practical Steps to Prepare Now

- Check that your tax returns and benefit accounts have your current address and bank information.

- Save important documents in a secure place and make digital copies of IDs or tax transcripts.

- Watch official government websites and sign up for alerts from your tax agency.

- Avoid sharing personal data with third-party sites claiming to speed up payments.

Small Real-World Case Study

Case: Maria, a single parent, had not filed taxes for the previous year due to a low income but filed the latest return after hearing about a potential $5000 payment. She updated her bank information on the non-filer portal when her state opened registration. When the program passed, Maria received a direct deposit within six weeks because her records were current.

Lesson: timely filing and using official portals can accelerate payment delivery.

Final Checklist for $5000 Stimulus Checks 2026

- Confirm your contact and bank info with tax/benefit agencies.

- File a tax return if required or use an official non-filer tool.

- Monitor official announcements for eligibility and payment schedules.

- Beware of scams—use only government domains for information.

Keeping records current and following official guidance are the most reliable ways to ensure you receive any approved $5000 stimulus checks in 2026. Check government websites regularly and be ready to act when registration or payment portals open.