This guide explains the 2000 direct deposits coming February 2026: who qualifies, when payments arrive, and how beneficiaries and bank details affect delivery. Read the steps to confirm eligibility and troubleshoot common problems.

2000 Direct Deposits Coming February 2026: Eligibility and Dates

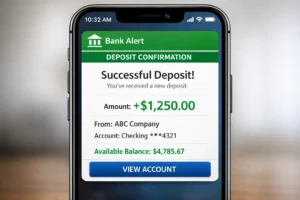

The program schedules one-time direct deposits of 2000 for qualifying recipients in February 2026. Eligibility is based on income, filing status, or program enrollment depending on the administering agency. Exact criteria and dates vary by jurisdiction, so check the official notice you received.

Who typically qualifies for the 2000 direct deposits coming February 2026

Common eligibility groups include low-to-moderate income households, seniors on certain benefits, or households enrolled in specific relief programs. Eligibility may depend on:

- Adjusted gross income thresholds

- Filing a tax return or registering with a government portal

- Receiving an existing benefit or having a qualifying dependent

Required documentation and beneficiary guidelines

To receive a direct deposit, agencies usually require valid bank account information and identity verification. If the payment is intended for a beneficiary, documentation proves the beneficiary relationship and right to receive funds.

Typical beneficiary documentation includes:

- Proof of identity (government ID)

- Proof of relationship (birth certificate, adoption papers, or court order)

- Bank account authorization or direct deposit form signed by the account holder

How beneficiary rules affect the 2000 direct deposits coming February 2026

If a payment is assigned to a beneficiary account, the paying agency will require clear authorization. Authorized agents, guardians, or representatives may need to submit legal documents showing they can accept funds on behalf of the beneficiary.

Payment dates and timeline

Payments are scheduled across February 2026 in batches to manage volume. Your payment date depends on your eligibility group, verification status, and when your bank processes incoming deposits.

Typical timeline phases:

- Pre-verification: Agencies confirm eligibility (late January–early February).

- Deposit batch processing: Payments are initiated in weekly batches during February.

- Bank posting: The recipient’s bank posts the deposit—this may take 1–3 business days after initiation.

How to find your expected deposit date

Check communications from the issuing agency (email, portal message, postal mail) for a scheduled batch window. If you have an account with the agency’s online portal, log in to see your status and expected deposit week.

How to confirm bank and beneficiary information

Confirm bank account routing and account numbers in the portal or by submitting a signed direct deposit form. Incorrect details cause delays or returned payments.

Follow these steps to confirm information:

- Log in to the issuing agency portal and review your direct deposit settings.

- Compare the account and routing numbers with a recent bank statement.

- If the payment is for a beneficiary, upload required documents and a signed authorization form.

- Contact the agency immediately if you notice an error.

What to do if you don’t receive the deposit

Check your bank account for pending credits first. If nothing appears within 5 business days after the announced batch date, take these steps:

- Verify your account and routing numbers with the agency.

- Confirm the payee name and beneficiary status are correct.

- Contact the issuing agency’s support line and provide your reference or case number.

- Ask your bank to research incoming ACH transactions and returns.

Common reasons deposits fail

- Incorrect routing or account number

- Closed or frozen bank account

- Mismatched beneficiary name vs. account holder name

- Agency processing errors requiring reissue

Many agencies use staggered ACH batches in February to reduce bank processing errors. If your direct deposit is delayed, the agency may reissue the payment in a later batch rather than cancelling it.

Real-world example: Case study

Maria, a single parent, received a notice she qualified for the 2000 direct deposit coming February 2026. She logged into the agency portal to confirm her bank account and uploaded a copy of her ID and a signed direct deposit form. Her payment was scheduled for the second February batch and posted to her account two business days after initiation.

When a neighbor used an outdated account number, their payment was returned and reissued after they updated the routing details. The agency emailed instructions and a new deposit date within one week.

Checklist: Prepare to receive the 2000 direct deposits coming February 2026

- Confirm eligibility and registration with the issuing agency.

- Verify bank routing and account numbers in your profile.

- Upload beneficiary or authorization documents if required.

- Monitor email and agency portal for your batch date.

- Contact support promptly if the deposit is missing after 5 business days.

Following these practical steps will reduce delays and help ensure the 2000 direct deposits coming February 2026 reach the intended recipient. Keep records of all communications and bank statements in case you need to request a reissue or file a dispute.