Federal authorities have scheduled sizable $2,000 deposits for February 2026. This guide explains who is likely to receive them, the confirmed distribution dates, and the practical actions you should take now to avoid delays.

Big $2,000 Federal Deposits Scheduled for February 2026 — Who Is Eligible

Eligibility typically depends on income, filing status, and prior enrollment in federal programs. Many recipients are existing benefit recipients or taxpayers who meet specific criteria set by the issuing agency.

Common eligibility categories include:

- Recent taxpayers who filed returns for the relevant tax year and qualified under income limits.

- Social safety-net program participants already enrolled for direct deposit.

- Households that previously received targeted relief or stimulus payments and meet the revival criteria.

Who is not eligible for Big $2,000 Federal Deposits

Not everyone will qualify. Non-filers, dependents without required documentation, and those with incomes above the established thresholds are commonly excluded.

Residents who have outstanding verification steps with the issuing agency may also see delays or denials until they complete required actions.

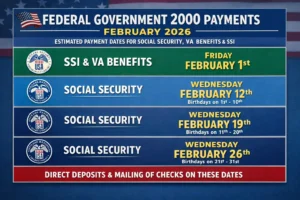

Dates Confirmed for Big $2,000 Federal Deposits in February 2026

Distribution dates are confirmed for mid- to late-February 2026. Payments will roll out in batches to manage system load and reduce processing errors.

Key timing points to watch:

- Primary batch: February 15–18, 2026 — direct deposits to enrolled accounts.

- Secondary batch: February 22–28, 2026 — paper checks and late direct deposits.

- Follow-up notices: early March 2026 — confirmations and instructions for those who need to verify details.

How distribution timing affects you

If you already have direct deposit on file, you are likely to be in an early batch. Paper checks take longer, so expect extra days for mail delivery.

Processing times vary by bank and program, so allow several business days from the confirmed date for funds to post.

Key Actions for Big $2,000 Federal Deposits in February 2026

Follow these steps now to increase the chance of a smooth deposit and reduce the need for follow-up.

- Verify your contact and bank details with the issuing agency. Use official portals only.

- Check your eligibility status online or by phone before the distribution start date.

- If you are missing documentation, submit it immediately. Common items include ID, SSN, or recent tax forms.

- Watch your account for small test deposits if required for verification and confirm them quickly.

- Keep an eye on official email or SMS alerts; do not rely solely on mail for time-sensitive notices.

Example checklist:

- Confirm direct deposit routing and account number.

- Update mailing address for paper checks.

- Scan and upload any requested documents.

- Monitor your bank starting Feb 15, 2026.

How to check status and resolve issues

Use the official payment portal or hotline provided by the issuing agency. Keep a record of confirmation numbers and correspondence.

If a deposit does not arrive by the expected date, contact the agency first, then your bank. Most delays are resolved with a single verification step.

Even when deposits are scheduled on a specific date, your bank may post funds later due to internal processing. Always allow up to five business days after the scheduled date before filing a missing payment claim.

Practical tips to avoid delays with Big $2,000 Federal Deposits

Simple precautions can prevent most problems. Update information early and keep documentation handy.

Tips that help:

- Sign up for direct deposit if you haven’t already; it’s faster and more reliable than paper checks.

- Use two-factor authentication on official accounts to protect your payment records.

- Store confirmation emails and screenshots of submitted forms in a dedicated folder.

What to do if you receive a notice but no payment

If you receive a notice confirming eligibility but see no funds, verify account details immediately. Mistyped routing or account numbers are a common cause of non-delivery.

File a help request with the issuing agency and provide proof of your account details. Most agencies have expedited review lanes for payment issues tied to scheduled distributions.

Small Real-World Example

Case study: Maria, a part-time nurse, confirmed her direct deposit in January. On February 15 she received a deposit notification and the $2,000 posted to her account the same day.

She used the funds to cover overdue medical bills and set up an emergency savings transfer. Because she updated her information early, she avoided the wait many receiving paper checks experienced the following week.

Final checklist before the February 2026 payments

- Confirm eligibility and enroll where needed.

- Update direct deposit or mailing address before early February.

- Keep documentation ready and monitor official channels for any last-minute changes.

Following these steps will give you the best chance of receiving the big $2,000 federal deposit on schedule. If you run into trouble, contact the issuing agency promptly and keep records of all interactions.