What happened with the $2,000 IRS cash giveaway

Reports in early 2025 described a $2,000 one-time cash payment distributed by the IRS in February. The announcement triggered immediate public reaction, with supporters praising relief and critics questioning fairness and process.

This article explains reasons for the outrage, describes who most likely deserves a payment, and offers practical steps households can take to protect themselves and confirm eligibility.

Why the outrage over a $2,000 IRS cash giveaway?

Several practical concerns drive the backlash. People worry about fairness when a large one-time payment appears sudden or poorly targeted.

Other common complaints include potential for fraud, unclear eligibility rules, and the fiscal impact of large payouts without clear offsets.

Key reasons for public frustration

- Perceived unfairness: Some taxpayers who need help most fear they will be excluded.

- Administrative confusion: Rapid rollouts can mean missed notices or delayed deposits.

- Fraud risk: Scammers often exploit new government payments with phishing and fake calls.

- Budget concerns: Critics question whether one-time funds are the best use of public money.

Who deserves the $2,000 IRS cash giveaway?

Determining who “deserves” a payout depends on policy goals. If the aim is immediate relief, targeted payments to low-income households are most effective.

Here are practical criteria policymakers and citizens often consider when deciding who should receive such payments.

Suggested priority groups

- Low-income families and individuals below a defined income threshold.

- People who missed prior stimulus payments due to filing issues or identity problems.

- Unemployed workers and those facing long-term job loss or reduced hours.

- Seniors and disabled people on fixed incomes who have limited buffers for emergencies.

How eligibility could be determined

An effective eligibility system balances fairness, speed, and fraud prevention. Here are common approaches.

- Income-based thresholds using the most recent tax return.

- Automatic enrollment for Social Security recipients and those on government benefits.

- Special provisions for households hit by natural disasters or sudden income loss.

Practical steps to prepare and protect yourself

Whether you expect a payment or not, take steps now to avoid mistakes and scams. These steps are simple and actionable.

Checklist

- Verify your tax filing status and update your address with the IRS if needed.

- Sign up for direct deposit on your IRS account to receive payments quickly.

- Watch for official IRS notices but be ready to ignore unsolicited calls and texts about payments.

- Keep records of income and benefit statements to resolve eligibility questions fast.

How to spot and avoid scams tied to the payment

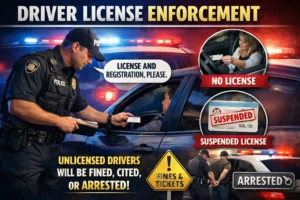

Scammers use events like this to trick people. The IRS will never demand payment via gift cards or ask for private account passwords over the phone.

If you get a suspicious message claiming to be from the IRS, do not click links or call numbers provided. Use irs.gov or the official IRS phone numbers to verify.

The IRS posts updates about direct payments and eligibility on IRS.gov. Always check the official site before acting on an email or phone call about government payments.

Case study: An illustrative example of who benefits

Maria is a single parent working part-time and relying on tax credits to make ends meet. Her 2024 tax return showed low income, and she had no savings when a one-time payment was announced.

Under a targeted policy using tax returns, Maria would receive the $2,000 payment automatically via direct deposit. That cash would cover overdue bills and help her avoid high-interest loans.

This example shows how focused payments can quickly stabilize households that lack buffers, while broader, untargeted programs may spread resources thinly.

Questions to ask your lawmakers and local leaders

If you want to influence how payments are distributed, ask officials these practical questions. Clear answers can improve fairness and transparency.

- What income thresholds or rules will determine eligibility?

- How will the IRS prevent fraud and identity theft during distribution?

- Will there be a process to claim missed payments later?

- How will this payment be paid for and what are the long-term budget implications?

Bottom line

Outrage over a $2,000 IRS cash giveaway in February 2025 reflects real worries about fairness, fraud, and how public funds are used. Targeted payments aimed at people with the greatest need tend to produce the most immediate benefit.

For individuals, the best steps are practical: confirm your IRS filing status, enroll in direct deposit if eligible, keep records handy, and verify any communications using official IRS channels.

Stay informed and contact your local representatives if you want to shape how relief measures are implemented. Clear rules and transparent distribution reduce public anger and help the people who need support most.