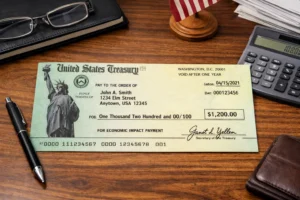

As discussions about a possible $2,000 stimulus check in 2026 surface, many Americans want clear, practical guidance. This article summarizes what is known today about the proposal, how it would move through the system, who might qualify, and what you should do now.

$2,000 Stimulus Check in 2026: Overview of the Proposal

The proposal under discussion would provide a one-time $2,000 payment to eligible individuals or households. The idea is to give direct cash support to households to ease cost-of-living pressures.

Important: a presidential proposal alone does not create payments. Congress must pass enabling legislation and the IRS or Treasury has to implement distribution rules.

Key elements often mentioned

- Payment amount: $2,000 per eligible adult or per household depending on the final bill.

- Eligibility rules: could be universal or income-limited; dependents may or may not be included.

- Timing: any payment would require a congressional vote and agency setup, so distribution would not be immediate.

How a $2,000 Stimulus Check Becomes Law

Understanding the legislative path helps set expectations for timing and certainty. There are three practical steps between a proposal and people receiving money.

1. White House proposal and drafting

The president or an adviser publicly proposes the payment and asks Congress to draft a bill. That proposal frames the amount, timing, and eligibility priorities.

2. Congressional approval

Congress must pass a bill authorizing the payment. This can happen as part of a larger spending package, a stand-alone bill, or through budget reconciliation if rules allow.

Expect negotiations over offsets, eligibility thresholds, and funding sources. Those negotiations are the main source of delay or change.

3. Implementation by Treasury and IRS

If a law passes, Treasury and the IRS issue guidance on how to send payments — direct deposit, checks, or debit cards. Agencies set processes for verifying eligibility and handling disputes.

What We Know Today About Eligibility

At the time of writing, explicit eligibility details for a 2026 payment are not finalized. Past stimulus programs give clues but are not guarantees.

Possible eligibility scenarios

- Universal adult payment: all adults receive $2,000 regardless of income.

- Means-tested payment: full amount for below a given income, phased out above a threshold.

- Per household model: one payment per tax filer or per household rather than per person.

- Dependent inclusion: children or other dependents may be counted for additional payments.

Each design affects who benefits, how much the program costs, and how quickly it can be administered.

Timing, Funding, and Political Roadblocks

Even a widely supported idea faces practical limits. Funding must be found through budget allocations, reallocated spending, or new borrowing.

Political disagreements over cost, deficits, and fairness often slow or reshape stimulus bills. Expect compromise on amount, phaseout levels, or targeted groups.

Practical timeline expectations

- Proposal announcement to bill drafting: days to weeks.

- Committee debate and floor votes: several weeks to months.

- Agency implementation and distribution: weeks to months after a law is signed.

In short, do not expect immediate payments; preparation and patience are necessary.

Practical Steps to Prepare for a 2026 $2,000 Stimulus Check

Whether or not the stimulus happens, take practical steps so you are ready if a payment is approved. These actions also protect you from common scams.

- Keep your IRS records updated: ensure the IRS has your current bank account and mailing address through your most recent tax return or direct updates.

- Monitor official sources: WhiteHouse.gov, IRS.gov, and your members of Congress for verified updates.

- Beware of scams: the government will not charge fees or ask for passwords to deliver funds.

- Plan savings or debt use: treat any possible payment as short-term cash for emergency savings or high-interest debt repayment.

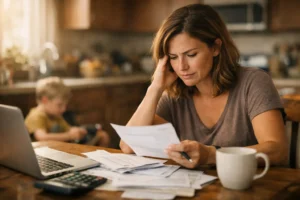

Small Case Study: One Family’s Choices

Maria is a 34-year-old single parent who works part time. If a $2,000 payment is approved and issued to taxpayers by direct deposit, Maria would likely receive the funds into her bank account within weeks after Treasury starts distribution.

She plans to split the payment: $1,000 to an emergency savings account, $600 toward overdue utility bills, and $400 for a month of groceries. That approach reduces short-term stress and avoids high-interest credit use.

Maria’s plan shows a practical way to use a one-time payment for stability rather than discretionary spending.

Possible Tax and Benefit Interactions

Most past stimulus payments did not count as taxable income, and they generally did not affect eligibility for federal means-tested programs. However, rules can differ by law.

If a new payment is enacted, read agency guidance for specifics about Social Security, Medicaid, SNAP, or housing benefits to see whether a payment affects eligibility or reporting requirements.

Checklist when a payment is announced

- Confirm whether the payment is taxable.

- Check if it must be reported to benefit programs.

- Follow IRS/Treasury guidance for claiming an unavailable payment or correcting errors.

Bottom Line

The $2,000 stimulus check proposal in 2026 is an idea that depends on Congress to become reality. Key unknowns include who qualifies, how quickly payments could be delivered, and whether payments will be universal or means-tested.

Prepare by keeping tax and bank records current, monitoring official announcements, and planning how you would use any one-time payment. Avoid scams and do not count on funds until Congress passes a law and agencies begin distribution.