This guide explains what to expect from the VA Disability Pay Increase 2026, how eligibility works, how to estimate your new monthly amount, and when payments will arrive. The steps are practical and designed to help you confirm any change in benefit levels.

How VA Disability Pay Increase 2026 Works

VA disability pay increases are typically tied to the annual cost-of-living adjustment (COLA) that Social Security announces in October. When a COLA is approved, the VA updates disability compensation rates for the following year.

The increase usually takes effect on December 1 of the year the COLA applies. Most current recipients do not need to apply to receive the increase; it is applied automatically to their monthly benefit.

Key points about the increase

- The VA usually follows the Social Security COLA percentage.

- New rates take effect December 1 and are reflected in subsequent payments after processing.

- Special Monthly Compensation (SMC), dependency allowances, and pension payments are also generally adjusted.

VA Disability Pay Increase 2026 Amount: How to Estimate Your New Pay

Official 2026 dollar amounts are published by VA when the COLA is finalized. You can estimate your new amount by applying the COLA percentage to your current monthly rate.

Step-by-step estimate

- Find your current monthly rate on your latest VA statement or at VA.gov under compensation rates.

- Obtain the official COLA percentage announced for 2026 (this is posted by Social Security and VA in October).

- Multiply your current rate by (1 + COLA decimal). Example: with a 3% COLA, multiply by 1.03.

- Round according to VA posting rules and check the official rate table when released.

Example calculation (hypothetical)

For illustration only: if your current monthly benefit is $1,500 and the 2026 COLA is 3.2%, compute $1,500 x 1.032 = $1,548. This gives a rough estimate of the new monthly amount.

Eligibility for VA Disability Pay Increase 2026

Eligibility for the pay increase is simple: you must already be receiving an eligible VA benefit that is affected by COLA. That includes most disability compensation and VA pensions.

New or pending claims approved late in the year may receive retroactive payments covering the effective date. The increase itself is automatic for eligible, active recipients.

Who receives the increase

- Veterans with a service-connected disability receiving compensation.

- Survivors receiving Dependency and Indemnity Compensation (DIC), where applicable.

- Recipients of VA pension and many SMC levels.

VA Disability Pay Increase 2026 Payment Schedule

Payments are made on a monthly schedule. The VA generally posts the new rates with the COLA and implements them with the December 1 effective date. Your first adjusted payment depends on processing timing and your usual payment date.

Most disability compensation is disbursed on the first day of each month. If the first falls on a weekend or federal holiday, the VA often issues the payment on the preceding business day.

What to expect in December and January

- December 1 is usually the effective date for the new rate.

- You may see the increased amount in the December payment or in the next cycle if processing is delayed.

- If approved retroactively for an earlier month, the VA will issue a lump-sum payment for the months owed, adjusted by the new rate if applicable.

Practical Steps to Confirm Your 2026 Increase

Follow these steps to confirm and track your VA Disability Pay Increase 2026.

- Check VA.gov or your eBenefits/MyVA account for the official rate tables once posted.

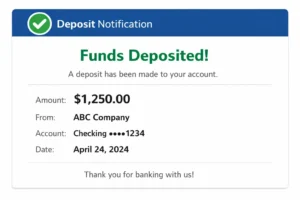

- Review your bank deposit on or after expected payment dates to see the adjusted amount.

- Contact the VA benefits line or your regional office if the increase does not appear and you think you are eligible.

- Save documentation showing the old and new amounts for tax or budgeting purposes.

VA disability COLA adjustments typically mirror the Social Security COLA and take effect December 1. This means most recipients see a change near year-end without submitting a new application.

Case Study: Real-World Example

John, a veteran with a 50% rating, receives a hypothetical monthly compensation of $1,200. When the 2026 COLA is announced at 3%, John estimates his new pay by multiplying $1,200 x 1.03 = $1,236.

John checks his eBenefits account in December and sees a retroactive payment covering the effective date along with an adjusted monthly deposit. He updates his household budget accordingly and saves the VA statement for his records.

Final Checklist Before the 2026 Payment

- Verify your current monthly rate on VA.gov.

- Note the official COLA percentage when announced in October.

- Estimate your new payment using the formula above and wait for VA to publish official tables.

- Monitor your bank account on scheduled payment days and contact VA if the increase is missing.

Official rates for VA Disability Pay Increase 2026 will be available on VA.gov when the COLA is finalized. Use this guide to estimate and prepare, and always confirm with the VA for exact amounts and dates.