Overview of the Federal Government $2,000 Payments Scheduled for February 2026

The federal government has scheduled $2,000 payments to eligible individuals for February 2026. This article explains who may qualify, the distribution timeline, how to check payment status, and practical steps you can take now.

What the Federal Government $2,000 Payments Are

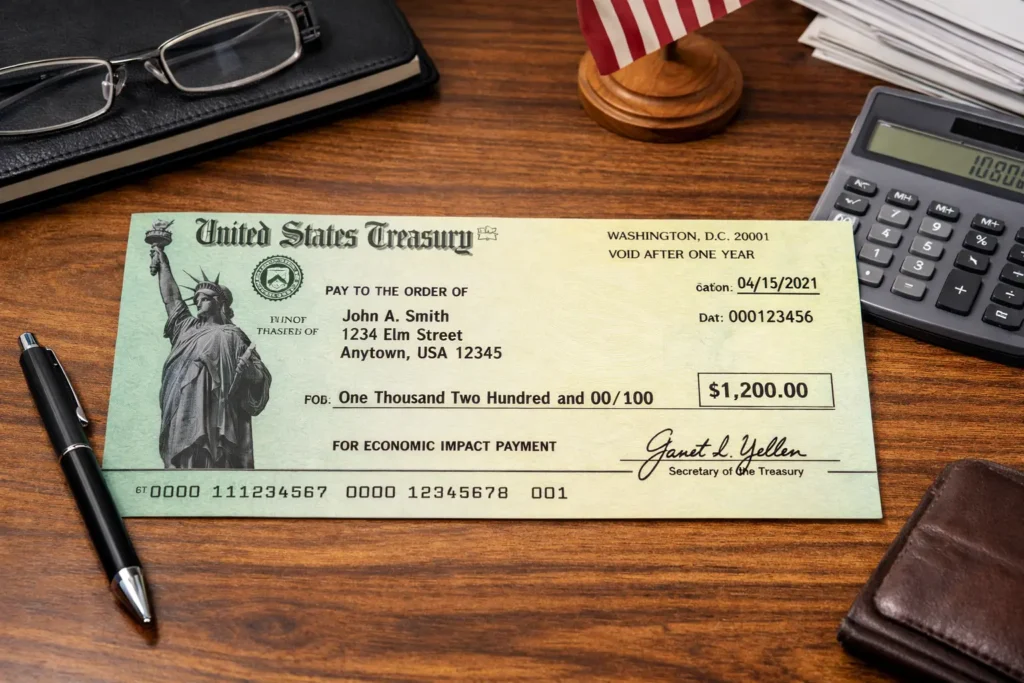

The $2,000 payments are one-time direct deposits or mailed checks provided by a federal program announced for February 2026. The program aims to deliver quick financial support to qualifying households and individuals.

Distribution methods include electronic transfer, paper checks, and prepaid debit cards, depending on your registration and records with federal agencies.

Who Is Eligible for the $2,000 Payment

Eligibility generally depends on income, filing status, and recent interactions with federal benefit systems. Common eligibility criteria include:

- Income under a specified threshold for the most recent tax year.

- Citizenship or qualifying resident status as defined by the program.

- Not being claimed as a dependent on another taxpayer’s return.

Exact rules can vary. Check the official federal announcement or your agency portal for your specific eligibility details.

Documents and Records That Help

Having the following ready speeds verification and payment delivery:

- Most recent tax return or earnings statements

- Social Security number or taxpayer identification

- Bank routing and account numbers for direct deposit

How the Payments Will Be Distributed

Payments are distributed in phases starting in early February 2026. The exact date depends on the agency handling your record and whether you have direct deposit on file.

Typical distribution steps include verification, authorization for payment, and electronic transfer or mailing of a check.

Common Distribution Methods

- Direct deposit to bank accounts on file — fastest method

- Mailed checks — may take longer depending on postal service

- Prepaid debit cards — used when bank information is missing

How to Check Payment Status

Use official federal websites or agency portals to check status. Do not rely on unsolicited emails or texts.

Steps to check your status:

- Log in to the official federal account portal you use (for example, IRS or benefit portals).

- Look for a payment or stimulus section and search by payment name or date.

- If unsure, call the agency’s official phone number listed on their website.

Tax and Reporting Considerations

Most one-time government payments have specific tax rules. Some payments are non-taxable, while others may require reporting.

Recommended actions:

- Keep records of the payment: date received, amount, and method of delivery.

- Check IRS guidance for whether this payment is taxable or needs to be reported on next year’s return.

- Consult a tax professional if you receive related notices or are unsure.

What to Do If You Don’t Receive the Payment

If you expected a payment but did not receive one by mid-February 2026, take these steps:

- Verify eligibility and last known payment method in your federal account portal.

- Confirm your mailing address and bank account on file are current.

- Contact the program’s official support line or help center for a status update.

Keep notes of dates, names, and confirmation numbers for any calls you make.

How to Avoid Scams and Fraud

Scammers will target high-profile government payments. Protect yourself by recognizing common red flags.

- Do not share Social Security numbers or bank account details in response to unsolicited calls or messages.

- Official agencies will not demand payment or ask for your account password to send a check.

- Verify links before clicking; go directly to the official agency website instead of using links in emails.

Some past one-time federal payments were automatically deposited using bank details from tax filings or benefit records. If you changed banks since your last filing, the payment may be mailed instead.

Practical Example: A Small Case Study

Maria is a single parent who qualified for the $2,000 payment based on her recent tax return. She had direct deposit on file, so her payment posted to her bank account on February 10, 2026.

She used the funds to pay two weeks of rent and buy groceries. Because she kept careful records of the deposit and transaction receipts, she easily answered a follow-up verification request from the agency.

Quick Checklist Before February 2026

- Confirm eligibility and review the announcement from the official federal source.

- Update your bank and mailing information in the agency portal.

- Gather tax records and ID to speed verification if contacted.

- Be alert for scams and use only official channels to verify payment status.

Where to Find Official Information

Always rely on federal agency websites and official statements for the most accurate information. Bookmark the agency page related to this payment and check it periodically for updates.

If you need additional help, use the phone numbers and contact forms listed directly on official pages rather than on third-party sites.

Following these steps will give you the best chance of receiving the $2,000 payment quickly and safely in February 2026. Keep documents current, verify your delivery method, and watch for official updates.