Overview of what needs to happen for Trump’s $2,000 tariff checks

This article explains the legal and administrative steps required for Trump’s $2,000 tariff checks to be sent to Americans. It outlines the roles of Congress, the executive branch, and the agencies that would handle payments.

Step 1: Legislative authority and appropriation

First, Congress must pass and the president must sign a law authorizing the $2,000 tariff checks. That law needs to specify who is eligible and the source of funds.

Appropriation is crucial. Even if policy authority exists, federal agencies cannot spend money without funds explicitly provided by Congress.

Key legislative elements

- Authorization of payment amount and eligibility rules

- Designation of funding source, such as tariff revenue or general funds

- Appropriation language permitting the Department of the Treasury to disburse payments

Step 2: Determining legal basis for using tariff receipts

Advocates may propose using tariff collections to fund the checks. That approach faces legal and practical tests about how tariff revenue is categorized under federal law.

Congress would likely need to include explicit provisions tying tariff receipts to the payment program to avoid legal challenges and budgetary complications.

Common legal questions

- Are tariff collections designated for specific trust funds or available for general spending?

- Does reassigning tariff funds require offsets or changes to budget scoring?

- Could opponents sue to block the use of tariffs for payments?

Step 3: Budget office and Congressional scoring

Once a bill is drafted, the Congressional Budget Office and the House and Senate budget offices would score its fiscal impact. This scoring influences support and amendment negotiations.

Lawmakers often seek offsets to pay for new spending, such as cuts elsewhere or revenue changes, which complicates passage.

Step 4: Political path in Congress

For checks to become law, the bill must pass both the House and Senate and then be signed by the president. The legislative path can vary depending on the majority control and priorities.

Possible vehicles include a standalone bill, attachment to an appropriations bill, or inclusion in a larger budget reconciliation package.

Practical tactics legislators may use

- Attach the checks to a must-pass funding bill to force a vote

- Use reconciliation if the policy fits budget rules and the majority supports it

- Negotiate offsets to satisfy fiscal hawks

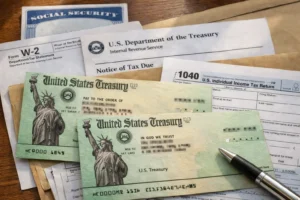

Step 5: Administrative setup by the Treasury

If the law is enacted, the Department of the Treasury would create the payment mechanism. This includes defining eligibility, verification processes, and delivery methods.

Implementation can take weeks to months depending on complexity and whether existing systems can be reused.

Implementation tasks for Treasury

- Establish eligibility database or cross-check with IRS records

- Set up direct deposit, paper check, or prepaid card systems

- Issue guidance and a public timeline for payments

Step 6: Addressing eligibility and verification

Lawmakers must decide who qualifies. Options include all adults, households under income thresholds, or those who filed recent tax returns.

Verification reduces fraud but can slow distribution. Using IRS or Social Security Administration records speeds validation.

Step 7: Distribution logistics and timeline

The Treasury would choose methods to distribute checks. Direct deposit is fastest, followed by mailed checks and prepaid cards.

Timelines depend on scale. A nationwide program could take one to three months to reach most recipients after funding is in place.

Potential obstacles and how they can be resolved

Obstacles include legal challenges, funding disputes, and administrative delays. Each requires targeted responses from lawmakers and agencies.

Common obstacles

- Legal challenges to funding source — require clear statutory language

- Political opposition — require negotiation or alternative offsets

- Administrative capacity — use existing IRS systems to speed deployment

Congress has used tariff revenues in the past for specific programs, but routing them to direct payments commonly requires new statutory language and appropriations.

Small real-world example or case study

Case study: In 2020, Congress approved emergency pandemic relief payments using IRS systems. The IRS issued direct deposits within weeks to people who had recent tax filings or Social Security records.

That example shows how using existing tax agency infrastructure makes large-scale payments feasible once Congress provides clear authority and funding.

What individuals can do while lawmakers act

Citizens can contact their representatives to express support or concerns. Clear public input can speed congressional movement or affect the final design.

Keeping tax records updated and ensuring direct deposit information is current can also help individuals receive payments faster if the program moves forward.

Summary: The checklist for payments to be sent

- Congress passes a law authorizing $2,000 checks and specifying eligibility

- Appropriations are provided or tariff receipts are explicitly designated

- Budget offices score the bill and offsets are resolved

- President signs the bill into law

- Treasury and IRS implement verification and distribution systems

- Payments are disbursed by direct deposit, checks, or cards

Following these legal, budgetary, and administrative steps is essential for Trump’s $2,000 tariff checks to be sent to Americans. The timeline depends mainly on political agreement and the speed of implementation once funding is in place.