This guide explains what beneficiaries should know about the federal $2,000 payments scheduled for February 2026. It covers eligibility checks, payment methods, what to do if a payment is missing, and real-world examples to help you act quickly and confidently.

What to expect from Federal $2,000 payments scheduled for February 2026

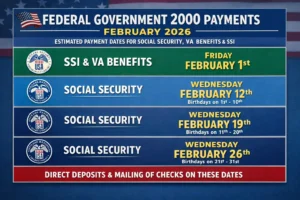

Payments are planned to reach qualified recipients during February 2026. Exact timing can vary by payment method, region, and the administering agency.

Expect direct deposits to arrive first, then mailed checks and debit cards. Official notices will come from the federal agency responsible for the program.

Who qualifies for the Federal $2,000 payments

Qualification rules vary by program but commonly include income limits, citizenship or residency requirements, and benefit status. Check the official guidance from the issuing agency for the final eligibility list.

Common beneficiary groups often considered include:

- Social Security retirement and disability beneficiaries

- Supplemental Security Income (SSI) recipients

- Veterans receiving certain federal benefits

- Low-income households meeting specified thresholds

How to check your eligibility for Federal $2,000 payments

Use these practical steps to confirm eligibility before the payment date. Start early to avoid delays.

- Visit the official program website listed in federal notices.

- Log in to your benefits portal (Social Security, VA, or other agency) to view payment announcements.

- Call the agency phone number from an official source if you cannot access online services.

How beneficiaries receive Federal $2,000 payments

Payments are typically issued by direct deposit, prepaid debit card, or paper check. The method depends on what the agency has on file for you.

Common delivery notes:

- Direct deposit: Deposits often post on a scheduled date tied to benefit cycles.

- Prepaid debit card: Cards may be mailed ahead of the payment date or loaded electronically.

- Paper check: Allow extra days for mail delivery, especially in rural areas.

Verify your payment method

Confirm your current payment details in your benefits account. Update bank account information as soon as possible if it has changed.

If you use direct deposit, ensure your bank routing and account numbers are correct to avoid returned payments.

What to do if you do not receive the Federal $2,000 payment

If the payment is missing after the expected timeframe, follow a clear set of steps to resolve the issue.

- Check your online benefits account for payment status or notices.

- Confirm your payment method and address in the agency records.

- Wait at least 7–10 business days after the posted payment date for mail delivery.

- If still missing, contact the issuing agency using a phone number from their official website.

Keep records of your calls, reference numbers, and any confirmation emails. These details speed up investigations and corrections.

Tax and benefit implications of Federal $2,000 payments scheduled for February 2026

Whether payments are taxable depends on the program rules. Some federal payments are tax-free while others may be considered taxable income.

Also check whether the payment affects means-tested benefits like Medicaid or SNAP. Many programs exclude certain federal lump-sum payments, but confirm with your caseworker.

Some federal payments are excluded from benefit calculations for programs like Medicaid and SNAP. Always verify with your local benefits office before assuming an impact.

Documents and information to have ready

When verifying eligibility or reporting a missing payment, having the right documents speeds up the process.

- Recent benefit award letters or statements

- Government-issued ID (driver’s license, state ID, or passport)

- Bank routing and account numbers if updating direct deposit

- Mailing address and phone number on file

Real-world example: A small beneficiary case study

Maria is 68 and receives Social Security retirement benefits by direct deposit. In January she confirmed her account info online after receiving a notice that a federal lump-sum payment would be sent in February 2026.

When the deposit did not appear on the expected date, she logged into her account and found a notice that the payment would be sent by check due to a bank account verification issue. She updated her direct deposit, called the agency using the number on the notice, and arranged for reissue. The replacement check arrived within two weeks.

This case shows the value of checking notices, keeping contact info current, and acting quickly if a payment is delayed.

Quick checklist for beneficiaries

- Check official agency notices and program pages regularly.

- Verify payment method and update bank details if needed.

- Keep documents and ID handy for verification calls.

- Allow extra time for mailed checks and cards.

- Document interactions with agencies for follow-up.

Where to get official help

Always use official agency websites or published phone numbers for help. Avoid sharing personal information with unofficial callers or websites that are not government domains.

If you need more assistance, contact your local benefits office, a trusted nonprofit that helps seniors or low-income households, or the issuing federal agency directly.

Use this guide to prepare for the federal $2,000 payments scheduled for February 2026. Acting early and keeping records will reduce the chance of delays and make it easier to resolve any problems quickly.