If a $2,000 payment is being issued by the IRS in February 2026, this guide explains who may qualify, how direct deposit works, key payment dates, and the step-by-step actions you should take to receive funds quickly and securely.

Get $2,000 From IRS in February 2026 — What to expect

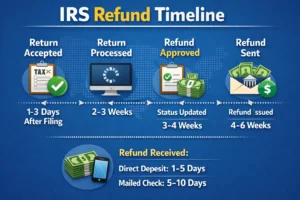

The IRS typically issues authorized payments via direct deposit, paper check, or prepaid card. If you are eligible for a $2,000 payment, the fastest method is direct deposit to the bank account on file.

This article covers eligibility checks, how to confirm or add direct deposit, likely payment dates, and troubleshooting tips if the payment is delayed.

Who is eligible to Get $2,000 From IRS in February 2026

Eligibility depends on the law or program authorizing the payment. Common factors include adjusted gross income (AGI), filing status, and whether a taxpayer filed a recent return or claimed certain credits.

Typical eligibility criteria to check:

- Filed a federal tax return for the most recent tax year.

- AGI is within the program limits (check IRS notices for thresholds).

- Not claimed as a dependent on another taxpayer’s return.

- No outstanding issues flagged by the IRS, such as identity verification holds.

How direct deposit works for the $2,000 IRS payment

If the IRS has a qualifying bank account on file, they will usually send payments by direct deposit first. Direct deposit is faster and safer than paper checks.

To receive the payment by direct deposit, the IRS needs a valid routing and account number from a previously filed return or from your IRS online account profile.

Payment dates for Get $2,000 From IRS in February 2026

Exact payment dates are set by the IRS once a payment is authorized. For a payment labeled February 2026, expect deposits to appear during that month in waves based on taxpayer records.

Common timing patterns:

- Week 1–2: Direct deposits to taxpayers with current bank information.

- Week 2–4: Paper checks and prepaid cards mailed to addresses on file.

- Ongoing: Corrections, replacements, and delayed payments processed in subsequent weeks.

Steps to receive your $2,000 from IRS in February 2026

Follow these steps to help ensure you receive the payment without delay. Take action early to confirm your information is correct.

1. Check eligibility and IRS announcements

Look for official IRS notices and announcements that explain eligibility and timelines. The IRS will publish details on its website and send letters to eligible taxpayers.

2. Confirm your filing status and recent return

Make sure you filed a federal tax return for the last required year. If you did not file, check whether the IRS allows registrations or non-filer portals for the payment.

3. Verify or add direct deposit information

To confirm your bank account, log into your IRS online account or check your last filed return where you included direct deposit details. If you need to update bank information, follow the IRS instructions carefully and only use official IRS portals.

4. Watch for IRS letters and email alerts

The IRS will not initiate contact by email to request sensitive information. Expect mailed notices if there are problems. Keep an eye on your account’s mail and the IRS online account messages.

5. Track the payment

Use official IRS tracking tools if available. The IRS sometimes adds a payment tracker within its ‘Get My Payment’ or account services. Allow one to two weeks after a posted payment date for banks to post deposits.

6. What to do if you do not receive the payment

If you expected the payment but did not receive it, take these steps:

- Confirm your eligibility and that your filing information was processed.

- Verify your direct deposit info or mailing address.

- Look for IRS letters that explain holds or identity verification requirements.

- Contact the IRS only via official phone numbers listed on IRS.gov if a notice instructs you to call.

The IRS typically sends direct deposits faster than mailed checks. If your bank account is on file from a recent refund, it may be used automatically for authorized payments.

Real-world example: A quick case study

Maria filed her 2024 tax return and included direct deposit information for her refund. When the IRS announced a $2,000 authorized payment in February 2026, Maria did not need to update anything.

Her payment posted via direct deposit on the second wave of distribution. Maria received an IRS notice in the mail confirming the deposit and saw the funds in her account two business days later.

Common questions and practical tips

Here are quick answers to frequently asked questions and some tips you can use right now.

- Can the payment go to my bank account automatically? Yes, if the IRS already has your account on file from a recent return or claim.

- What if my bank info changed? Update your account with the IRS if a portal is available, or expect a mailed check if the IRS has no current bank record.

- How long to wait? Wait at least 4–6 weeks from the start of the payment window before contacting the IRS about a missing payment.

Final checklist to prepare now

- Confirm you filed the required tax return and meet eligibility rules.

- Check that the IRS has your current bank account or mailing address.

- Watch for official IRS announcements and mailed notices.

- Use IRS.gov or the official phone numbers for any follow-up.

Following these steps will give you the best chance to receive any authorized $2,000 IRS payment in February 2026 by direct deposit. Keep records of your returns, bank details, and IRS notices to speed up verification if needed.