Quick overview of IRS Approves $2000 Deposits for February 2026

The IRS has approved one-time $2000 deposits scheduled for February 2026. This guide explains how the program works, who is likely to qualify, what documents you need, and the deposit dates and tracking steps.

Who may qualify for the $2000 deposits

Eligibility will depend on an IRS announcement and the program rules it sets. Generally, these payments target taxpayers who meet filing or benefit criteria from the prior tax year.

Common eligibility elements to check:

- U.S. citizenship or resident alien status and a valid Social Security number.

- Filed a 2025 tax return or used an official non-filer registration portal, if provided.

- Income and filing status that meet the program’s limits (refer to the IRS notice for exact thresholds).

- Not claimed on another taxpayer’s return as a dependent.

Special groups often included

Programs like this often include Social Security beneficiaries, SSI recipients, and some retired federal benefit recipients. Check the IRS announcement for confirmation of included groups.

Required documents and information

Before the deposit window opens, gather documents that speed up verification. Keep these items handy:

- Most recent tax return (2025). Include adjusted gross income and filing status pages.

- Social Security number or ITIN for each taxpayer and eligible dependent.

- Bank routing and account numbers for direct deposit.

- Proof of identity and address if the IRS requests manual verification.

How to confirm eligibility and enroll

Follow these steps to confirm or update your payment details.

- Visit IRS.gov and search the official notice or FAQ for the $2000 deposit program.

- Use the IRS online tools (for example, Get My Payment or a new portal specified by the IRS) to check status and provide banking details.

- If you do not have direct deposit on file, follow IRS guidance to add or update account information before the cutoff date.

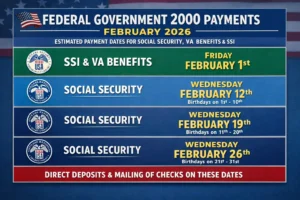

Deposit dates and timeline for February 2026

The IRS typically staggers large payments to manage processing. Below is a plausible schedule format the IRS commonly uses. Always confirm the exact dates and the order with the IRS.

- Early February: Direct deposits to Social Security and federal benefit recipients.

- Mid February: Direct deposits to eligible taxpayers who filed electronically with direct deposit information.

- Late February: Mailed checks and prepaid debit cards issued to addresses on file.

Expect status updates and a tracking window on IRS.gov. The IRS will likely provide a lookup tool to check payment status by Social Security number and last name.

What to do if you don’t receive the deposit

If you qualify but do not receive a payment by the end of the announced schedule, take these actions:

- Check the IRS payment status tool first.

- Verify your address and bank routing number with the IRS tools or your most recent tax return.

- Contact the IRS via the phone numbers and support pages listed on IRS.gov only.

Example case study: Single parent claim

Maria is a single parent who filed a 2025 tax return claiming one dependent. She receives Social Security benefits and used direct deposit for her refund last year. After the IRS announcement, Maria confirms her direct deposit information on the IRS payment portal and sees her status listed as scheduled. Her bank posts a $2000 deposit in mid-February.

Key takeaways from Maria’s example:

- Filing timely and keeping direct deposit info current speeds receipt.

- Checking the IRS portal lets you confirm scheduled deposit dates and avoid mail delays.

Common questions and practical tips

Here are answers to frequently asked questions and practical steps to reduce delays.

- Q: Can I get the deposit if someone else claimed me as a dependent? A: Usually not. The IRS will follow program rules tied to dependency claims.

- Q: What if my bank account closed? A: Update account details immediately on the IRS portal; if the IRS already sent the payment, contact your bank and the IRS for next steps.

- Q: Will I owe taxes on the $2000? A: Check the IRS guidance; many one-time payments are non-taxable, but confirm the specific announcement.

Final checklist before the deposit window

- Confirm eligibility on IRS.gov and read the official FAQ.

- Update your bank routing and account number, or confirm mailing address if you expect a paper check.

- Keep digital copies of your 2025 tax return and ID documents accessible in case verification is required.

- Use the IRS payment tracker once the IRS opens the lookup service.

These deposits are intended to reach qualifying taxpayers quickly, but processing times can vary. Always rely on official IRS communications for the latest rules, exact qualification details, and the confirmed deposit schedule.

Note: This article summarizes expected rules and steps based on the IRS announcement. Verify all details at IRS.gov or by contacting the IRS directly before making decisions.