Overview of the IRS 2000 February 2026 Deposit

The IRS 2000 February 2026 deposit is a one-time federal payment that some taxpayers will receive during February 2026. This guide explains who is likely eligible, how the payment schedule typically works, and what to do if you do not receive the deposit.

Who is eligible for the IRS 2000 February 2026 deposit

Eligibility depends on rules announced by the IRS and federal legislation. Common eligibility requirements include a valid Social Security number, qualifying adjusted gross income limits, and filing status requirements.

To prepare, confirm these basics:

- Primary taxpayer or spouse has a valid SSN.

- You filed the most recent required tax return, or the IRS has your information from other federal records.

- Your income and dependent status meet the limits set by the IRS for this payment.

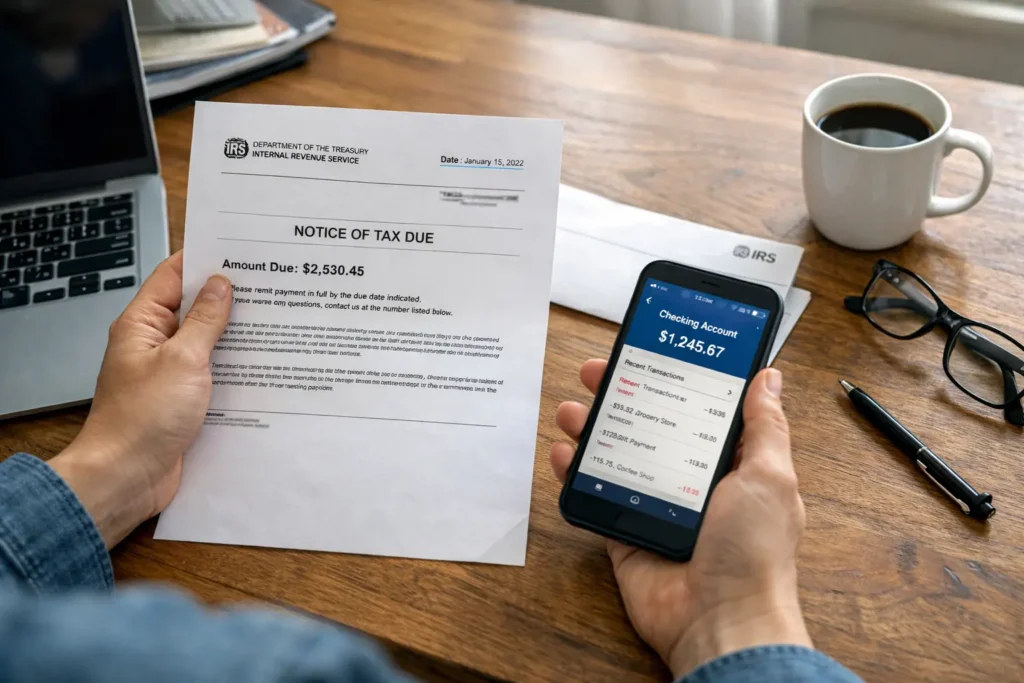

Documents to check before claiming

- Most recent federal tax return (2024 or 2025 as applicable)

- Social Security numbers for you and eligible dependents

- Bank routing and account numbers if you want direct deposit

How the IRS 2000 February 2026 deposit schedule works

The IRS typically issues payments in phases. Direct deposit is faster and often sent first, while mailed paper checks and prepaid debit cards are sent later.

What to expect in February 2026:

- Direct deposit notices and funds could appear in eligible accounts in early to mid February.

- Mailed checks or cards may be ordered and sent in later weeks, reaching some recipients after February.

- The IRS may post schedules or updates on its official site, including tools to check payment status.

Typical timeline example

- Week 1: IRS finalizes payment lists and initiates direct deposits.

- Week 2: Many direct deposits post to bank accounts; IRS updates online tools.

- Weeks 3-6: Mailed payments and cards arrive for recipients without direct deposit info.

How to check payment status for the IRS 2000 February 2026 deposit

Use official IRS resources to verify payment status. The IRS often offers a payment status tool within its account services or a dedicated page for one-time payments.

Steps to check:

- Visit IRS.gov and search for the official payment status tool or your IRS online account.

- Provide identity info as required, such as SSN, filing status, and address or tax return details.

- Review the tool for deposit method, date sent, and any action required.

What to do if you did not receive the IRS 2000 February 2026 deposit

If the tool shows no record of payment, or you expected a deposit and did not receive it, follow these steps.

- Verify bank account numbers if you used direct deposit. A closed or changed account can block funds.

- Check for an IRS notice mailed to your address. Notices explain why a payment was not issued.

- If you did not file a recent tax return and were required to, file the return to establish eligibility.

- If you believe you qualify but did not receive payment, you may be able to claim a credit on your next tax return. Review IRS instructions for the applicable credit, such as a one-time payment credit or similar recovery credit.

Filing to claim a missed payment

If the IRS requires a tax return to issue or validate the payment, file the relevant year return promptly. The agency may allow qualified individuals to claim a credit on the next return if they qualify but missed the deposit.

Practical steps to claim or fix a missing payment

Follow these practical steps, in order, to resolve most missing payment issues.

- Check the IRS payment status tool online for details on your deposit.

- Confirm your bank info and IRS account address are current.

- Look for any IRS notices that explain a denial or hold.

- File the required federal tax return or an amended return if the IRS requests additional documentation.

- Contact the IRS directly if you cannot resolve the issue using online tools. Keep records of calls and notices.

The IRS often sends a letter to recipients after issuing a one-time payment. Keep that letter with your tax records; it explains the amount and how it was calculated.

Real-world example

Case study: Maria, a single filer with a valid SSN, received an IRS 2000 February 2026 direct deposit. Her bank account information was current on her 2025 tax return, so the funds posted within two business days of the IRS release. Maria saved the IRS notice and confirmed the amount matched the notice. A neighbor, John, who had recently changed banks, did not receive the deposit. John used the payment status tool, found the payment was sent to his old account, and filed a correction with the bank and IRS instructions to issue a paper check instead.

Common questions and quick answers

- Q: When will I get the money? A: Direct deposit recipients often see funds first in February; mailed checks can take several more weeks.

- Q: Can I claim the payment later if I missed it? A: In many cases eligible taxpayers can claim an equivalent credit on their next tax return. Follow IRS guidance.

- Q: What if the IRS sent the payment to the wrong bank? A: Contact your bank immediately to attempt recovery and follow IRS guidance for a reissue if recovery fails.

Final checklist before February 2026

- Confirm SSN and dependent information are accurate on file.

- Update bank account and mailing address with the IRS or on your most recent tax return.

- Save any IRS notices you receive after payment issuance.

- Use official IRS online tools and follow published guidance to claim or correct a missing deposit.

Following these steps will help you verify eligibility, understand the payment schedule, and resolve most issues quickly. For the latest details, rely on IRS.gov and official IRS communications.