Overview: How a tariff rebate would work

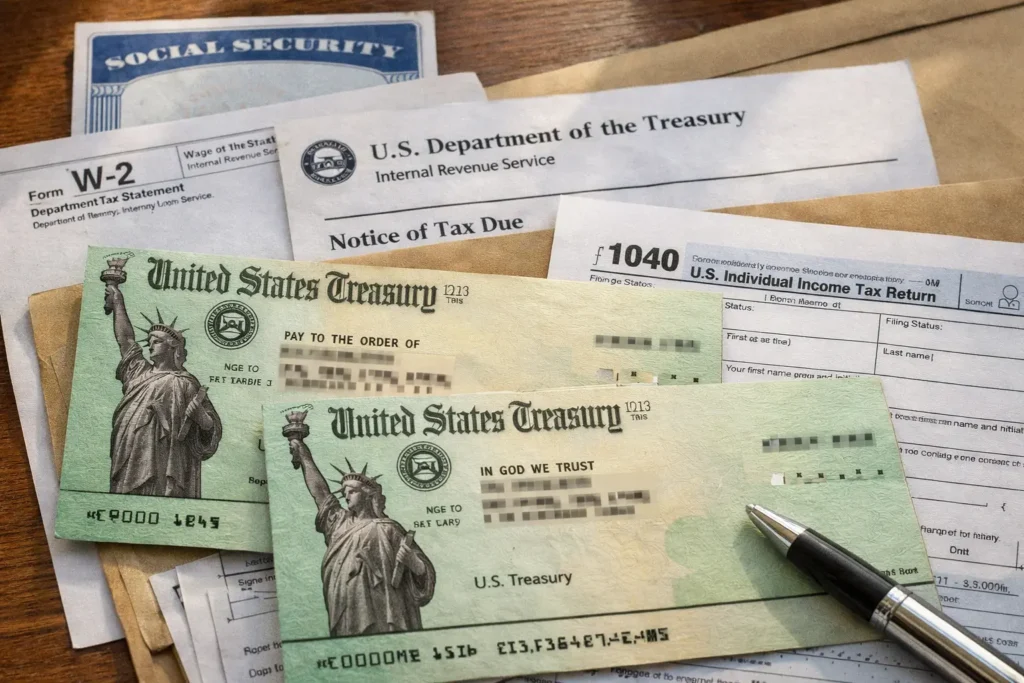

If the administration promised $2,000 tariff checks, that would mean returning some portion of revenue raised from import duties to individuals. Tariff revenue is collected by U.S. Customs and deposited to the Treasury, so moving money back to people requires legal and administrative steps.

This article explains the practical steps, likely timeline, and the obstacles that must be cleared before any $2,000 tariff checks can be sent to Americans.

Key legal and congressional steps for Trump’s $2,000 tariff checks

Tariff policy and tax-and-spend actions involve multiple branches of government. The most direct route to send payments to Americans is through federal legislation. Congress must authorize and appropriate funds or approve the mechanism the administration proposes.

Steps typically include drafting legislation, committee consideration, floor votes in both chambers, and the president’s signature. Without clear statutory authority, the Treasury cannot create a new entitlement or payment program on its own.

What legislation must specify

Any bill authorizing $2,000 checks should cover essential details so implementation is possible. Congress usually includes:

- Eligibility rules: who qualifies and whether it is means-tested.

- Payment mechanics: one-time payment, joint returns, minors, or households.

- Funding source: how tariff revenue will be allocated and tracked.

- Implementation authority: which agency handles distribution and timeline.

Administration actions and regulations

The White House and federal agencies must prepare administrative steps once a law or directive exists. That means writing rules, setting up IT systems, and coordinating with the Treasury and IRS for payment delivery.

If the administration tries to use existing authorities to redirect tariff funds, legal challenges are likely. Agencies will still need clear instructions on eligibility checks, fraud prevention, and data sharing.

How payments are likely to be delivered

The Treasury and IRS have experience issuing direct payments, like tax refunds or stimulus checks. They can reuse bank account data on file, Social Security records, and tax returns to route payments.

However, scaling a new payment requires time to adapt systems, test processes, and produce manual checks where deposit data is missing.

Practical timeline: From proposal to checks

Here is a realistic timeline for a new $2,000 tariff-check program assuming prompt political agreement.

- Drafting and introduction of legislation: 1–4 weeks.

- Committee review and markups: 4–8 weeks, depending on contention.

- Floor votes in House and Senate: 1–3 weeks after committee approvals.

- Implementation planning and Treasury/IRS setup: 4–12 weeks after enactment.

- First payments: likely 6–16 weeks post-enactment, depending on logistics.

Delays add up if bills stall or face veto threats, and litigation could further slow distribution.

Political and legal obstacles to expect

There are clear political hurdles. Lawmakers may contest eligibility rules, the cost, and whether tariff revenue is a stable funding source. Budget hawks may object to using general revenues for rebates.

On the legal side, opponents could challenge whether the administration can reassign funds without explicit congressional approval. International reaction and trade partners’ responses could also complicate matters.

Common legal challenges

Possible court questions include whether the statute authorizing tariffs allows redistribution to individuals, separation-of-powers concerns, or violations of existing appropriations law. Courts will examine statutory text carefully.

Economic and distribution considerations

Design choices affect who benefits and whether the program is efficient. A flat $2,000 check is simple but regressive if high-income households receive the same amount as low-income households.

Policymakers must also estimate how much tariff revenue is available and whether revenue volatility makes the program temporary or recurring.

Targeting and fairness

Options include means-tested payments tied to adjusted gross income or universal rebates. Each choice has trade-offs in administrative complexity, equity, and political feasibility.

Tariff revenue is recorded as customs duties in the federal budget and typically goes to the general fund, not a dedicated consumer rebate account. Congress must explicitly direct any rebate program.

Case study: How a payment might affect a household

Example: A retired teacher in Ohio receives Social Security and files taxes each year. If Congress passes a one-time $2,000 tariff check with an eligibility rule tied to Social Security recipients, the IRS could use existing SSA and tax records to send funds by direct deposit.

For this retiree, the payment would arrive more quickly than a program starting from scratch, because the IRS already has verified identity and deposit information. Households without bank records would receive mailed checks, adding processing time.

Action checklist for the coming weeks

If you want to follow or influence the process, here are practical steps to track progress and voice your opinion.

- Watch for bill text released by House and Senate committees.

- Read the funding source section to see if tariffs are dedicated or general revenue is used.

- Contact your representative to express support or concerns about eligibility and cost.

- Monitor Treasury and IRS guidance for implementation timelines if a bill passes.

Bottom line

A promise of $2,000 tariff checks requires concrete legal authority, congressional approval, and time for administrative setup. Expect debate over funding, eligibility, and legal authority before any checks are mailed.

Understanding the legislative steps and practical hurdles will help you track realistic timelines and likely outcomes as the plan moves through Washington.