This guide explains what to do if you see news about a $4983 direct deposit for everyone in the United States in 2026. It focuses on how to verify the claim, check eligibility, find official payment dates, and prepare your bank and tax records to receive a legitimate deposit.

$4983 Direct Deposit 2026: What it could mean

When headlines mention a specific payment amount like $4983, that usually refers to a government-authorized one-time payment, rebate, or benefit adjustment. Federal payments are announced by agencies such as the IRS, Social Security Administration, or Congress, and are always published on official websites.

Before assuming you qualify, verify the announcement with primary sources. Unofficial posts, social shares, or emails can misstate eligibility or invent payment programs.

How to check eligibility for $4983 Direct Deposit 2026

Follow these steps to confirm whether you or your household qualify for a $4983 payment:

- Visit official sites: IRS.gov, SSA.gov, or USA.gov for program details.

- Look for legislation: Search for any new law or federal budget item that authorizes the payment.

- Check eligibility rules: Look for income limits, filing requirements, or enrollment windows in the official announcement.

- Confirm identity and records: The government will rely on recent tax returns, Social Security records, or other federal databases to determine eligibility.

Common eligibility triggers

Programs typically use one or more of the following criteria to determine eligibility:

- Recent federal tax return (adjusted gross income and dependents)

- Social Security or disability benefit status

- Household income thresholds

- Citizenship or lawful resident status

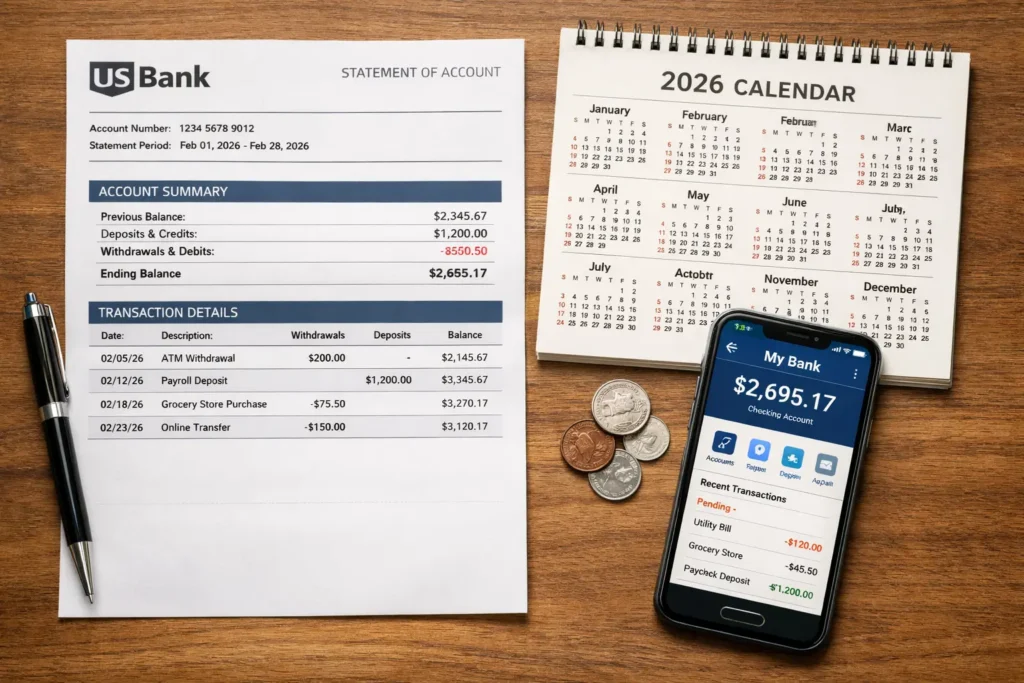

Payment dates and how direct deposit works

Official payment dates come from the agency administering the funds. If a $4983 direct deposit is authorized, expect a phased schedule rather than a single nationwide date.

Direct deposit uses the bank account information on file with the paying agency. Typical timelines look like this:

- Announcement and enrollment window (if required)

- Verification and eligibility checks (1–8 weeks)

- Batch disbursements by bank routing numbers over multiple days or weeks

How to confirm a real deposit

To confirm a legitimate $4983 direct deposit:

- Check your official agency account (IRS Get My Payment or SSA account).

- Look for mailed notices to your last known address.

- Monitor your bank account for a deposit from a government payor name (e.g., TREASURY, SSA).

The U.S. Treasury and IRS publish advance notices for major direct-payment programs. Always verify payment details on Treasury.gov or IRS.gov before acting on messages claiming you will receive a large payment.

Steps to prepare for a potential $4983 direct deposit

Preparing your information ahead of a payment announcement reduces delays and the risk of fraud. Key preparation steps include:

- Update your bank account details with the IRS or SSA if you already have an online account.

- Make sure your mailing address and contact info are current on tax and SSA records.

- File any outstanding tax returns — many programs use recent tax data to determine eligibility.

- Beware of scams asking for upfront fees or personal login information.

Real-world example

Case study: Maria, a single parent in Ohio, heard about a possible $4983 payment. She did the following: created an account on IRS.gov, confirmed her direct deposit routing number from last year’s tax return, and signed up for official email alerts. When the program was announced, she received an official notice and saw the deposit on the date listed in the agency’s schedule. Her proactive steps avoided delays and prevented scammers from contacting her about the payment.

Common scams and red flags to avoid

False claims about guaranteed payments are a common tactic to steal personal data. Red flags include:

- Requests for immediate payment to release funds.

- Unsolicited calls or texts asking for Social Security numbers or banking passwords.

- Emails with links that ask you to log in to an unofficial site to claim a payment.

Always navigate directly to official government websites rather than clicking links in messages.

Where to find official updates and help

Use these trusted sources to track any $4983 direct deposit announcement and payment dates:

- IRS.gov — for tax-related payments and official Get My Payment tools.

- SSA.gov — for Social Security or supplemental benefit notices.

- Treasury.gov — for large federal disbursement schedules and notices.

- USA.gov — for general guidance and links to agency pages.

When in doubt, contact your bank and the issuing agency using phone numbers listed on their official websites. Keep copies of relevant tax returns and benefit letters to speed up verification if agencies ask for proof.

Following the steps in this guide will help you confirm whether a $4983 direct deposit applies to you, understand likely payment dates, and prepare your accounts to receive funds securely.