Overview of the IRS February 2026 refund timeline

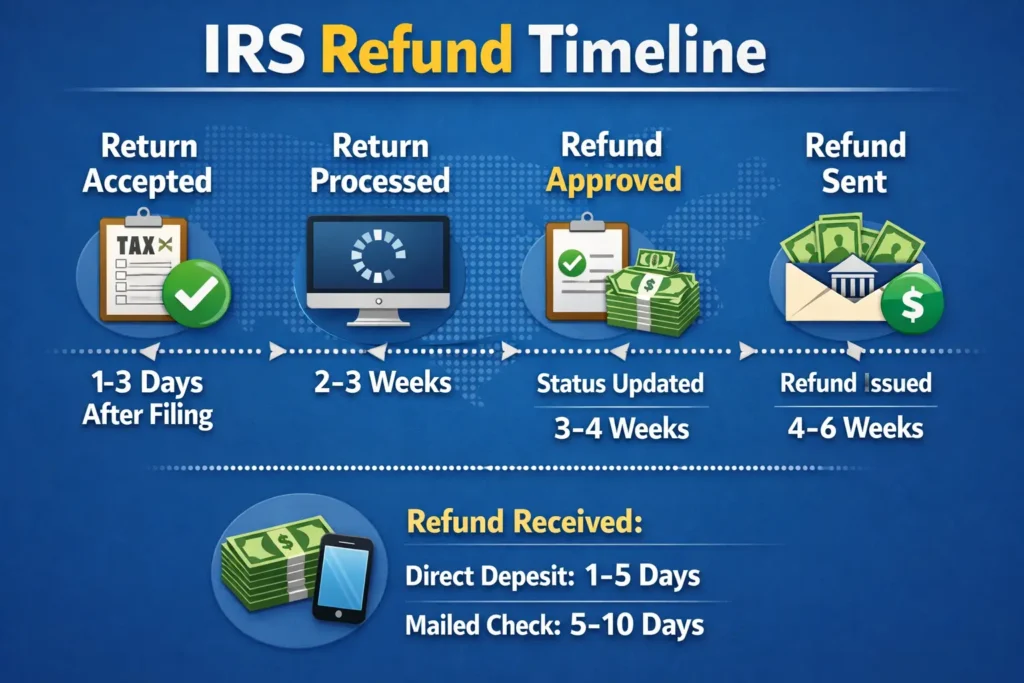

This article explains the IRS February 2026 refund timeline and gives practical guidance on estimated income tax refund dates and processing updates. It focuses on realistic time frames, common delays, and clear next steps you can take if your refund is late.

IRS February 2026 Refund Timeline: What to expect

The IRS follows standard processing rules but timing can shift each tax season. In February, the IRS begins issuing refunds after it starts processing returns and after statutory holds on certain credits are lifted for the year.

Key factors that shape the timetable include how you filed, whether you requested direct deposit, and if you claimed credits like the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC).

Estimated income tax refund dates

Below are typical timelines and realistic estimates for refunds in February 2026. These are ranges, not guarantees.

- E-filed returns without EITC/ACTC: Often 7 to 21 days after the IRS accepts the return.

- E-filed returns that claim EITC or ACTC: Refunds generally start being issued in mid-February and may take up to 21 days after acceptance.

- Paper-filed returns: Expect 6 to 12 weeks from the IRS receiving the return.

- Amended returns (Form 1040-X): Typically 12 to 16 weeks from when the IRS gets the amended return.

- Refunds held for identity verification or errors: Varies; could add several weeks depending on resolution time.

Processing updates and official holds

The PATH Act requires the IRS to delay refunds for returns claiming EITC or ACTC until mid-February each year. That timing affects when those refunds appear on the IRS schedule.

The IRS also issues periodic processing updates online. These updates can note system backlogs, staffing changes, or temporary delays that might lengthen the timeline for February 2026.

Why refunds are delayed: common processing updates

The IRS posts processing updates, but individual processing delays usually fall into several categories. Knowing these helps you respond quickly.

- Identity verification requests or suspected fraud flags.

- Math errors, missing forms, or mismatched Social Security numbers.

- Claims for refundable credits like EITC or ACTC which trigger statutory holds.

- Adjustments after audits or review of income documents (W-2s, 1099s, K-1s).

- Processing backlog due to a high volume of returns early in the season.

How to check your refund status

Use official IRS tools first. The IRS updates refund statuses regularly and will indicate if you need to take action.

- Check ‘Where’s My Refund’ on IRS.gov. You will need your Social Security number, filing status, and exact refund amount.

- Use the IRS2Go mobile app for the same status updates on your phone.

- If a notice arrives in the mail, read it carefully and follow the instructions rather than waiting on status alone.

What to do if your refund is delayed

If your refund is later than the estimated range, take these steps to speed resolution:

- Confirm the IRS accepted your return and check the date of acceptance.

- Use ‘Where’s My Refund’ or IRS2Go for current status.

- Respond promptly to any IRS letter or identity verification request.

- If the IRS shows no record of your return, contact your tax preparer or the IRS helpline for follow-up.

Did You Know? The IRS often processes straightforward e-filed returns fastest, and most e-file refunds arrive within about 21 days. Returns claiming EITC or ACTC are typically delayed until mid-February to allow anti-fraud checks.

Small case study: Real-world February refund timing

Jane filed a simple e-file return on February 2, 2026 and chose direct deposit. Her return was accepted by the IRS on February 3 and her deposit posted 10 days later. This illustrates a common e-file timeline for returns without refundable credits.

By contrast, Mark filed a paper return on February 1, 2026 and waited eight weeks for his mailed refund check. Paper filing added significant processing time compared with e-filing and direct deposit.

Practical tips to avoid delays in February 2026

Follow these steps to reduce the chance of a refund delay.

- E-file whenever possible and choose direct deposit for the fastest payments.

- Double-check Social Security numbers, bank routing numbers, and all names and addresses before filing.

- Include all required schedules and third-party documents or attach an explanation if a form is pending.

- Monitor ‘Where’s My Refund’ and keep a copy of your return and confirmation records.

Understanding the IRS February 2026 refund timeline helps set expectations and gives you straightforward actions to take if problems arise. Use official IRS tools, keep documentation, and respond quickly to requests to minimize delays.