Overview of the 5000 Wells Fargo Settlement 2026

The 5000 Wells Fargo Settlement 2026 establishes a claims process for certain customers affected by specific account practices. The settlement includes eligibility rules and a payment schedule released by the settlement administrator.

This guide explains who qualifies, how payments will be made, and the steps to file a claim. Read each section carefully to confirm whether you should apply and what documents you may need.

Who is eligible for the 5000 Wells Fargo Settlement 2026?

Eligibility is limited to account holders and consumers who meet defined criteria in the settlement notice. Typically eligible individuals had accounts or services impacted during specified dates.

Common eligibility elements include:

- Having an active or closed Wells Fargo account within the covered dates listed in the notice.

- Experiencing the specific account practice cited in the settlement (for example, unauthorized fees or account openings).

- Not being excluded by the settlement terms, such as certain corporate accounts or persons who already received a full remediation.

How to check eligibility

Use the settlement website or call the settlement administrator to check eligibility by account number, name, or case ID. The official notice includes a simple eligibility checklist and the exact date ranges covered.

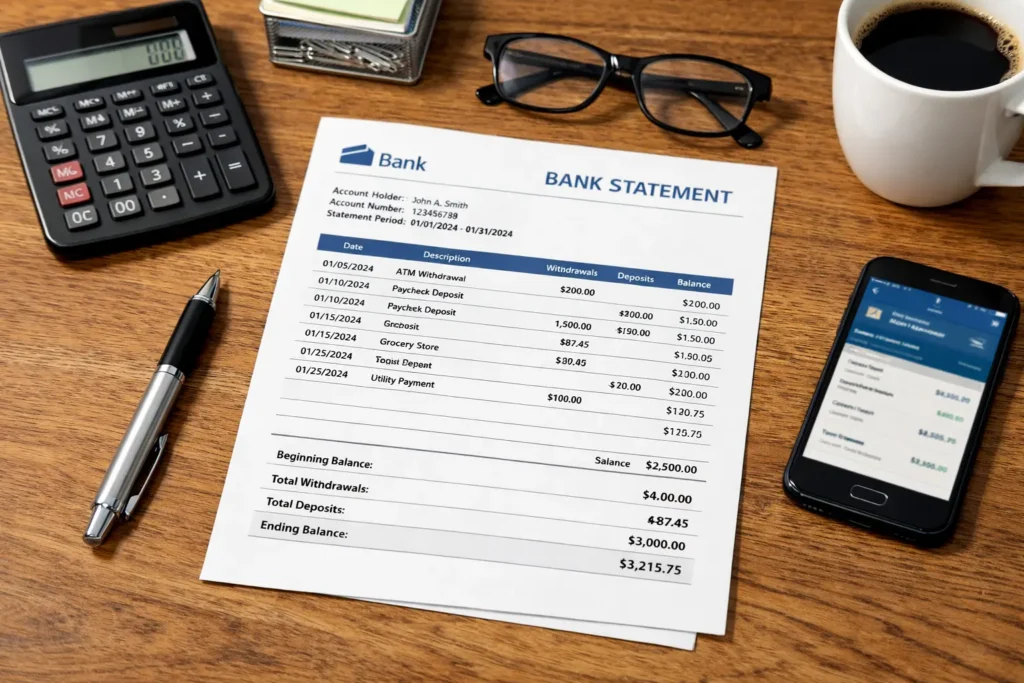

Keep your account statements and any correspondence from Wells Fargo handy to speed up verification.

Payment schedule for the 5000 Wells Fargo Settlement 2026

The payment schedule outlines when different groups of claimants will receive funds. The settlement lists phased disbursements based on claim type and documentation provided.

Key schedule points include:

- Initial distribution date for verified claimants, typically within 60–90 days after claim approval.

- Secondary distributions for late or deficient claims, often several months later.

- Final cutoff for submitting claims and appeals, which is binding after the deadline passes.

How much you can receive

The headline amount refers to the maximum per-claim payment of $5,000 under specific conditions. Actual payments may vary depending on the number of approved claims and pro rata adjustments.

Factors that affect payment size include claim category, documented losses, and administrative fees deducted from the settlement fund.

How to file a claim for the 5000 Wells Fargo Settlement 2026

Filing a claim usually requires completing an online form or submitting a paper claim to the settlement administrator. Follow the official instructions exactly to avoid delays or denial.

Typical steps to file:

- Visit the official settlement website and locate the claims portal.

- Complete the claim form with your personal information and account details.

- Attach required documents such as account statements, fee receipts, and identity verification.

- Submit your claim before the posted deadline. Save a copy or confirmation number.

Required documents and proof

Commonly requested documents are account statements showing the alleged issue, copies of transaction histories, and government ID to confirm identity. Keep originals if you may need to mail copies.

If you lack records, the settlement administrator may accept affidavits or other secondary proof. Check the claim instructions for acceptable alternatives.

Not all approved claimants will receive the full $5,000 listed in headlines. Final payouts depend on the total approved claims and administrative deductions.

Timeline and important dates

Deadlines and distribution windows are critical. Confirm dates on the official settlement website and in the mailed notice you received.

Typical timeline items include:

- Claim filing deadline (date set in the notice).

- Date when the settlement judge grants final approval.

- Initial and subsequent distribution dates.

What to do if you miss the deadline

Missing the claim deadline usually forfeits your right to payment. In rare cases, late claims may be accepted for a fee or under strict conditions. Contact the settlement administrator immediately if you think you qualify but missed the deadline.

Receiving payment and tax considerations

Payments may be issued by check, direct deposit, or electronic transfer depending on the options offered by the settlement administrator. The claim form will often ask for your preferred payment method and bank details.

Tax treatment varies. Settlement payments compensating for actual losses are often not taxable income, while interest or punitive components could be taxable. Consult a tax advisor for specific guidance.

Case study: One claimant’s process

Example: Maria had two accounts affected in 2019 and found the settlement notice in 2026. She checked eligibility on the official site and gathered statements showing unauthorized fees.

Maria submitted an online claim, attached three months of statements, and received a confirmation number. Her claim was approved in 75 days and she received a partial payment by direct deposit within three months of approval.

Tips to avoid delays

- File online if possible to speed processing and get instant confirmation.

- Include clear copies of required documents and label them as requested.

- Keep records of any correspondence and confirmation numbers.

- Monitor the settlement website and your email for status updates.

Where to get official help

Always use contact information provided in the official settlement notice. Settlement administrators typically run a help line and an FAQ page for common issues.

Avoid third-party firms that charge fees to file claims unless you verify their legitimacy and costs. You can file directly for free in most settlements.

Final steps

Confirm your eligibility, gather documents, and file before the deadline. Track your claim and follow the payment schedule to know when funds will arrive.

If you have questions about the 5000 Wells Fargo Settlement 2026, consult the official settlement website or contact the administrator listed in the notice.